are you investor ready?

Get 💰Funded Faster with a Bank-Approved, Investor-Grade Business Plan

Trusted by South African entrepreneurs and SMEs who are serious about securing R500 000 – R5 million from top funders — ABSA, FNB, SEFA, NEF, and IDC. This isn’t just another business plan. It’s a professionally built, funder-aligned, and data-backed pack designed to make banks and investors say yes. We build it using the same logic funders use to evaluate risk — so your plan speaks their language, not just yours.

WHY DO MOST BUSINESS PLANS FAIL❌?

🚫 The Harsh Truth: 8 in 10 South African Funding Applications Fail. WHY?

Most plans lack substance. Funders reject generic business plans written without credible market data.

No financial realism. Bank analysts instantly spot when numbers are inflated or incomplete.

No financial realism. Bank analysts instantly spot when numbers are inflated or incomplete.

No risk awareness. DFIs and investors assess not just opportunity, but your ability to manage downside.

Result? Missed approvals. Lost months. Wasted opportunities. That’s why the Pitch Gambit Standard Plan is built from real funder scoring criteria — covering the exact data, projections, and format that South African financial institutions expect to see. → Discover the 10 Things Banks and DFIs Check Before They Fund You.

🧭 THE SOLUTION

Our INVESTOR—GRADE STANDARD PLAN

A Perfect Pack for: Bank Loans, DFIs, and Investor Pitches🎯 Everything You Need to Win Credibility, Confidence, and Capital. Your Standard Plan combines data science, business logic, and investor psychology to make your proposal look — and feel — fundable. It’s designed to help your business move from “promising” to “bank-ready.”

💼 What do you get?

Ready to make your business vision compelling to funders? Receive your professional, data-driven business plan in 10 days and pitch with assurance. Our service links early validation with substantial funding, providing you with the confidence and clarity needed to impress investors.

✅ Comprehensive, Investor-Ready Business Plan

Built by Pitch Gambit’s professional strategists who understand the exact structure and scoring criteria used by South African banks, DFIs, and investors. Your plan reads like it came straight out of a funder’s office — not a template website. 📘 Perfect for: ABSA, FNB, SEFA, NEF, IDC, and Angel Investor Submissions.

✅ In-Depth Market & Competitor Research

We don’t just describe your market — we prove it.

Our analysts research local demand, pricing trends, and competitor data to give your plan funder-grade credibility.

That means lenders see evidence, not guesses. 📊 Benefit: Impresses funders with verified industry insights and market share clarity.

✅ 3-Year Financial Projections & Sensitivity Analysis

We go beyond one-year basics. You’ll receive a full three-year set of financial statements — income, expenses, cash flow, and balance sheet — complete with growth assumptions and stress testing. These numbers speak the language of funders and investors: sustainability and scalability. 💡 Benefit: Funders trust your repayment logic and future-proof vision.

✅ SWOT & Risk Assessment Matrix

Show funders you’re not just optimistic — you’re prepared.

We identify potential risks and provide clear mitigation strategies, turning your weaknesses into investor confidence. 🧠 Benefit: Satisfies DFI and bank risk-assessment criteria used in funding decisions.

✅ Professional Formatting & Investor-Grade Branding

Your plan won’t look “homemade.”

We format and design it using a clean, funder-friendly layout that mirrors professional investment documentation.

Every section is visually structured for clarity, flow, and readability. 💼 Benefit: Creates instant credibility and trust before they even read page one.

✅ Two Free Revisions to Perfect Your Pitch

Your feedback matters. We include up to two revisions, so you can refine your message and ensure every number, word, and paragraph reflects your business accurately.

No hidden costs — just peace of mind. 🖋️ Benefit: Guarantees your plan is polished, persuasive, and ready to submit.

✅ Delivered in 10–14 Business Days

You’ll have your full investor-ready plan, market data, and financials in your inbox within two weeks — professionally formatted and ready for submission. We prioritize your deadlines for competitions, tenders, and grant calls. ⏱️ Benefit: Fast, reliable turnaround — no missed opportunities.

Free Downloads

Get Our Free Resources Today!

Free Bonuses: (Limited Offer). Get the Funding Readiness Checklist (South Africa): Tick off these essentials before approaching funders, exact investor criteria. and our Pro” Mini-Guide (South Africa): An Investor Q & A Mastery for South African Entrepreneurs to help you "Pitch Like Pro Mini-Guide, "step-by-step investor Q&A prep.

Who is this offer Ideal For?

🇿🇦 BUILT FOR SOUTH AFRICAN SMMES

🏦 because South African Funders Don’t Read Business Plans — They Score Them

Plans designed 🧾 around SA -Funders' exact scoring matrices

This Standard Business Plan Pack is ideal for entrepreneurs and SMEs ready to raise between R500 000 – R5 million. Whether you’re applying for: A bank loan (ABSA, FNB, Standard Bank), A DFI facility (IDC, SEFA, NEF), Or an angel investor round — the Standard Plan positions you as a credible, fundable entrepreneur. Each plan passes our Funder Alignment Checklist, ensuring you’re never rejected for missing a required section or ratio.

🛡️ OUR RISK-FREE GUARANTEE

Your Plan Will Be Investor-Ready — Or We’ll Fix It Free. If your plan doesn’t meet funder standards, we’ll refine it at no extra charge until it does.

✅ 100% Funder-Alignment Guarantee

✅ Unlimited minor edits

✅ No hidden fees

We’re not done until your plan is ready to win.

Frequently Asked Questions❓

Q1: Do you guarantee funding approval?

A: We guarantee that your plan will meet the evaluation standards of South African funders — but no consultant can guarantee an approval, as final decisions depend on many factors. What we do promise is that your business plan will be crafted to pass bank and DFI review criteria, giving you the best possible shot at securing funding.

Q2: How long does the process take?

A: Our standard turnaround is about 10 to 14 business days from the time you provide all required information. We align our timeline with common South African funding deadlines, so you’ll be ready to apply on schedule.

Q3: Can I use this plan for multiple funders?

A: Absolutely. We design your plan in a modular way, so it can be easily adapted for different funders — whether you’re applying to a bank like FNB, a DFI like SEFA, or even pitching to angel investors. You get a versatile document that’s funder-agnostic.

Q4: Is there a payment plan available?

A: Yes. We offer a 50/50 split payment: 50% upfront to start the work, and the remaining 50% upon draft approval. This makes it easier for SMEs to manage cash flow while still getting a high-quality plan.

Q5: What industries do you specialize in?

A: We have successfully crafted plans for a wide range of South African industries — including agriculture, retail, manufacturing, tech, logistics, beauty, and more. Our consultants tailor the research and financials to your sector, so your plan resonates with industry-specific funders

Q6: What if I already have a business plan?

A: We offer a Plan Upgrade Service where we audit your existing plan and enhance it to meet the Standard Plan’s investor-grade criteria. This costs less than a full plan creation and ensures your current work isn’t wasted.

Client Success Stories

Nomusa Mthembu

KZN Catering Company (Durban)

““ABSA’s SME finance team called it one of the best-prepared proposals they’d seen.”

🟢 ABSA SME Working Capital Loan • Used for new kitchen equipment and staff expansion.

Thabo Dlamini

EcoFresh Juices (Midrand)

“Pitch Gambit restructured our plan — IDC approved R1.2 million in 6 weeks.”

🟢 IDC Manufacturing Grant • Job creation funding • Now producing over 8,000 bottles/month

Linda Khumalo

Tech Founder (Cape Town)

“We were finally investor-ready. Our angel round closed at R1.8 million.”

🟢 Angel Investment Round • SA Innovation Hub Program Participant.

100% Money Back Guarantee

Secure Your Investor-Grade Plan Before Pricing Goes Up for 2026

We guarantee that your plan will meet the evaluation standards of South African funders.

If your plan fails to meet funder standards, we’ll refine and re-submit at no extra cost — until it’s funding-ready. ✅ 100 % South African compliance

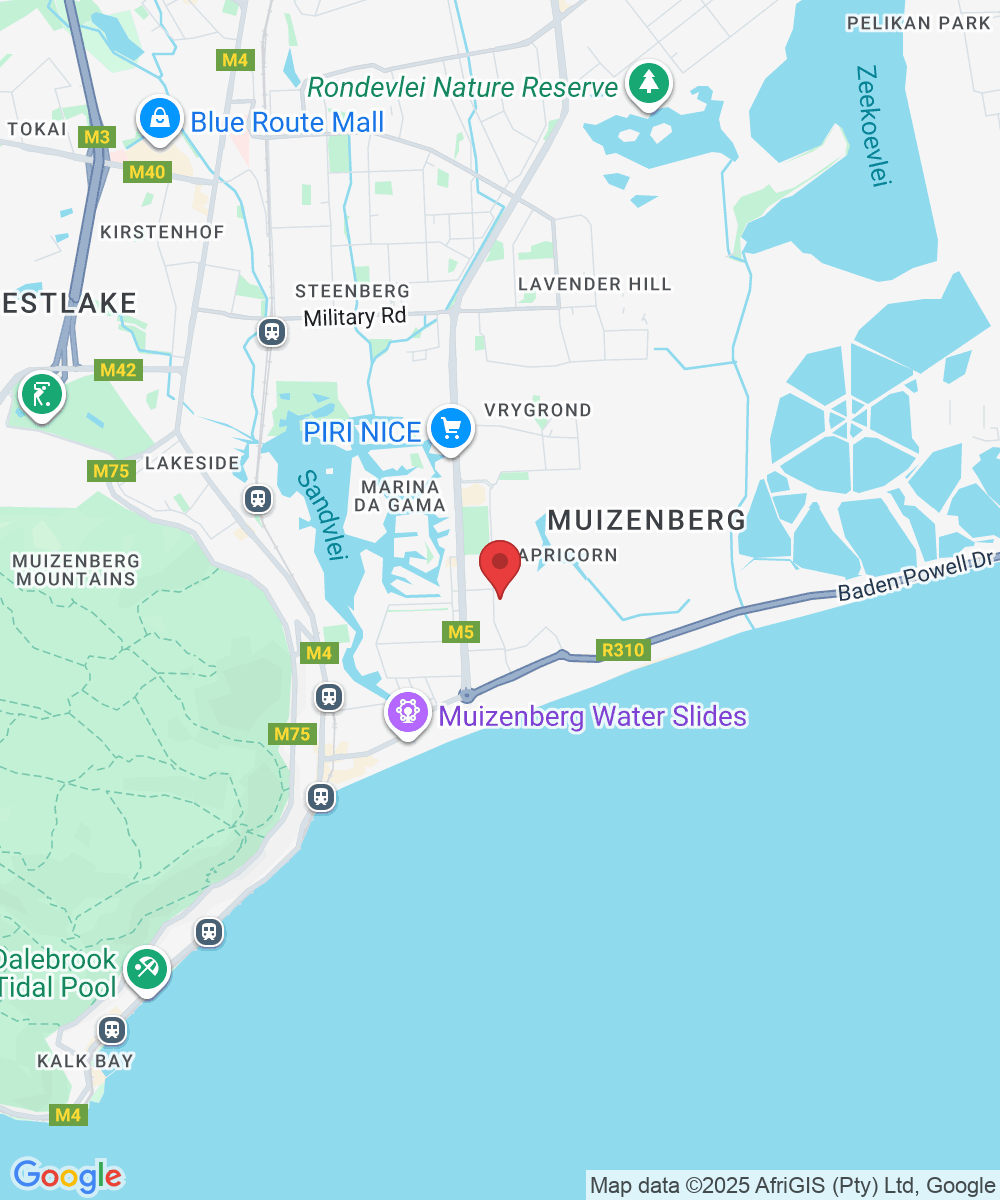

Location: 14 Sunrise Boulervard, Cape Town Western Cape 7945

Call 076 139 4876

Email: [email protected]

Site: Pitch Gambit